ABLEnding, Inc. has the ability to accommodate the funding for home purchases, refinancing, construction loans, home equity lines of credit, and commercial loans.

http://ablending.com/finance-options/

ABLEnding, Inc. has the ability to accommodate the funding for home purchases, refinancing, construction loans, home equity lines of credit, and commercial loans.

http://ablending.com/finance-options/

Buying your first home can seem overwhelming. Thankfully, there’s a lot of great information out there to help you feel more confident as you learn about the process. For those in younger generations who aspire to buy, here are three things to consider sooner rather than later in your journey:

Overall, Millennials make up the largest group of homebuyers in today’s real estate market, and Gen Z is not too far behind. A recent study shared by Freddie Mac shows, however, that Generation Z isn’t as confident in the homebuying process as Millennials. The best thing potential young buyers can do is understand what it takes to buy a home. Learn as much as you can about the mortgage process, down payment options, and the overall steps to take along the way.

Homeownership allows you the chance to put a small portion of the home’s value down when you buy, and then watch your appreciation grow on the full value of the home – not just on the down payment. It’s one of the best investments you can make, and a form of ‘forced savings’ working in your favor over time. The added bonus? You get to live there, too.

Having someone you trust to guide you through this process is invaluable. Finding a local real estate expert to help you navigate through the transaction and feel more confident as you make important decisions could be the best choice you make.

For Millennials and Gen Z’ers thinking about buying, today’s historically low interest rates combined with the outlook for future home appreciation is a big win. This means whatever you buy today, you’ll be bragging about 10 years from now. You can feel confident about that!

If you’re ready, buying your first home sooner rather than later is one of the best decisions you can make. But there are many things to consider before taking that step, so it is critically important to educate yourself properly and find someone who can help you confidently navigate through the full journey.

The post Confidence Is the Key to Success for Young Homebuyers appeared first on Keeping Current Matters.

The following blog post Remortgage – Isn’t It Time You Got A Better Deal? is available on: ABLEnding, Inc San Diego

Remortgage – Isn’t It Time You Got A Better Deal?

If you have had your mortgage for some time, then it could be a good idea to get it out and look at it real good. Why? Simply because you may be able to get a much better deal. With interest rates changing every day, new loan options, and increasing equity on your house, means that many factors may now mean that you could reduce your mortgage payments each month, or more. Here is how you can determine if a better deal is possible for you.

Decide On Future Plans

Remortgaging your house may not be for everyone. This is especially true if you are thinking of moving in less than three years – or even five. The main reason for this is the cost of refinancing your mortgage. There will be some closing costs involved, so it will take you anywhere between one and three years to get this money back in order to break even. But if you are planning on staying more than that, you should do some serious thinking about a remortgage.

Check The Current Rate For Mortgages

The interest rates that are available for mortgages change every day – sometimes even more often than that. The important thing is that they are constantly changing – both up and down. By watching trends on the mortgage rates, and knowing your own rate of interest, you can see when the rates drop to more than 1% lower than what you have now. That is the time to refinance. Or, even better, if you see a slow downward trend, wait a few more days or a week or so, and it may even go lower. You will have to decide on the best time. You may also want to consider the advice of those who know the market and make predictions.

Get Better Terms

Since your financial situation may have changed over recent years, you may want to make some adjustments on your mortgage that reflects those changes. If you are doing financially better, then you can remortgage, get lower rates, and a shorter time for repayment. This will result in saving a lot of money overall and get you out of debt quicker.

If, on the other hand, your financial situation has not been so good lately, and you are feeling the pinch on your finances, then remortgaging could allow you to get lower monthly payments, your some of your equity, and stretch out the time period for repayment. A longer time period, however, may result in greater indebtedness.

Consider Getting Some Of Your Equity

One more thing. Getting a remortgage can also give you access to your equity – some or all of it. There are different types of mortgages that you can get in order to get what you want. Although the best way to reinvest your equity is to put it back into the house – at least some of it, it could also give you opportunity to do a debt consolidation, to buy a car or boat, or pay for medical bills or college. The choice belongs to you as to how you use it. When you use it on your house, it also becomes tax deductible, too.

ABLEnding, Inc,

1455 Frazee Road

Suite 500

San Diego, CA 92108

(805) 209-0123

Mortgages. The Pitfall Of Interest Only Mortgages. is republished from: San Diego Mortgage Broker

In the first three months of 2002, just 9% of all new mortgages were taken as interest only – but by the last quarter of 2005, the figure had risen to 23%. And amongst first time buyers, the figures rose from 6% to 15%. (Source: Council of Mortgage Lenders.)

The reason is obvious. It’s down to family economics. With an interest only mortgage, the monthly repayments only repay the ongoing interest so your monthly repayment is low. Repayment of the capital borrowed is delayed to the end of the mortgage when it has to be repaid as a lump sum.

So the popularity of interest only mortgages is a reflection of borrowers wanting to minimise their fixed monthly outgoings in order to preserve their lifestyle – they still want their nice cars, nights out and holidays abroad. But their reluctance to cut back on their life style spending, combined with steadily rising house prices, could be storing up problems for the future. If they’re not repaying some of the capital now, how are they going to repay it?

Egged on by the concerns voiced by the Financial Services Authority (FSA), many lenders are now becoming much stricter when assessing an application for an interest only mortgage. They’re insisting that there’s a viable repayment vehicle in place before they’ll payout the money. These repayment vehicles could be the tax-free cash forecast from a pension policy, or an ISA or some other regular investment or savings scheme. The danger is that having got the mortgage, the borrower subsequently cancels their savings scheme.

If that were to happen, when retirement finally arrives accompanied by the looming commitment to repay the mortgage capital, they’ll be faced with having to sell their home and down size simply to free up money to repay the mortgage. And that’s a scenario that lenders and the FSA are anxious to avoid.

Twenty years ago interest only mortgages were the accepted norm with endowment policies being used as the most popular investment to repay the capital. But as we now know, returns on endowment policies have not been as high as many had assumed. This has left thousands of homeowners with a capital repayment shortfall. Endowment policies have certainly failed to be the “guaranteed “ repayment solution that many of us had assumed twenty years ago. So, in today’s economic and investment environment, how certain can you be of any scheme to repay the capital?

When the shortcomings of endowment policies slowly became understood, interest only mortgages fell out of favour and repayment mortgages took over as the norm. But once again the pendulum is swinging. Interest only mortgages are back in a big way. It’s the result of high house prices and people straining to get onto and up the housing ladder without wanting to economise on other areas of their spending.

We’re sure that the pressures within family finances will continue to fuel the demand for interest only mortgages. However, it becomes the duty of mortgage brokers and the lenders to point out the alternatives open to their clients.

In the past, a 25 year mortgage term has been the norm for a young buyer. But now they can stretch the repayment period to 30, even 35 years. This makes the payments on a repayment mortgage far more affordable.

For example, the monthly repayments for a £125,000 repayment mortgage over 25 years at say, 4.9% cost £731.69 per month, but if the repayment period was stretched to 35 years, the repayment drops to £628.16 per month, a cash flow saving of £103.53.

The idea is that as and when family finances permit, borrowers can reduce the capital outstanding by making optional lump sum repayments. In practice, people tend to move house every eight to ten years and at each move a new mortgage has to be organised. These moves then represent an obvious opportunity to reassess long-term family finances.

But other solutions are available. You could arrange a mortgage where part of the loan is on a repayment basis with the balance on interest only. It’s a mid way option. At least these types of mortgage start the repayment process and later when you move home or the family income builds, you can take the opportunity to reassess the most suitable type of mortgage.

But please bear in mind that you shouldn’t speculate when it comes to your home finances. Mortgages are complicated and there is never just one solution. Our advice is take professional advice and use a mortgage broker who can search the entire market.

ABLEnding, Inc,

1455 Frazee Road

Suite 500

San Diego, CA 92108

(805) 209-0123

Carolina Online Home Loans was originally published on: ABLEnding, Inc California Blog

Carolina Online Home Loans

Living in the Carolinas has so much to offer residents. Toasty summers, mild winters, lovely beaches, bucolic mountains, a thriving night life, several diverse communities, and great foodstuff are some of what you can find in this lively region. Home prices have been increasing steadily these past few years, therefore loan financing continues to play an important part in the local economy. Let’s take a look at some Carolina Online Home Loans you can apply for today!

Adjustable Rate Mortgages – affording a new home is simpler today as variable rate mortgages or ARMs remain popular with consumers. Interest rates on your ARM can be as much as one full percent lower than what you would pay with a fixed rate loan. Rates are generally set for the first few years of the loan and then adjust to the prevailing rates as determined by the government.

Introductory Rate ARMs – Carolina Online Home Loans are also available as Introductory Rate ARMs. Typically, with these types of loans, the rate is set low for a specified length of time. This can allow home owners, just like you, to get a larger home for the money.

Graduated Payment Mortgage – The GPM is another option to the traditional adjustable rate mortgage. Rates are set for one year and then rise at predetermined amounts in the ensuing years.

Fixed Rate Mortgages – These are one of the most prevalent and universally accepted Carolina Online Home Loans available. Rates are set throughout the term of the loan which is typically for 15 or 30 years. Other term packages offered by some Carolina lenders are for 20, 25, and even up to 40 years.

Balloon Mortgages – Balloon loans are short term mortgages that have some of the same features as a fixed rate mortgage. Typically, the rate is set notably low for a set period of time. At the end of that specified time, rates increase and the loan has essentially “come due” or you can refinance at that time to establish a lower variable or fixed rate.

So, no matter which type of loan you select, you may soon find yourself living in the Carolinas enjoying the good life. Search online today for your Carolina Online Home Loan!

ABLEnding, Inc,

1455 Frazee Road

Suite 500

San Diego, CA 92108

(805) 209-0123

There sure is a lot going on out there! There is talk of warehouse banks temporarily suspending funding refi biz, lenders charging lock fees, lenders & vendors restricting visits from outside personnel, avoiding RESPA violations but “pushing off” difficult loans or borrowers that are shopping rates, and lenders making their pricing more aggressive for purchases but creating a hit for refis. Of course lenders are increasing margins since it is the easiest way to cut volume in a hurry. Certainly pleas from LOs about, “Can’t we match our competition? They’re better than us by .125!” are going unheard. Lenders are increasing refi lock times to 90 days, and usually giving 30- or 60-day pricing regardless. And analysts are busy thinking about all of this. One wrote me, “What about the impact of a 12-15%, or higher, corona-virus driven drop in the stock market on purchase volume? While a refinance volume surge is happening, the impact of lower rates on purchase volume may be offset by the impact of financial losses in the stock market on down payments and a general unease about a weakening economy. We could be entering a ‘not the time to buy’ mentality, especially with expected significant layoffs in certain sectors, e.g., hotels, airlines, food and beverage, etc.” Meanwhile, JW Michaels & Company released its annual Financial Services Market Data Report showing compensation for various executive positions of top-tier financial services, accounting, legal, technology, and business institutions. (Of course, STRATMOR has its survey dedicated to the mortgage industry.)

Employment & promotions

Zoral Group Inc., an international leader and innovator in the AI/ML/Digital Products/RPA/Big Data space, is seeking a National Sales Director. Zoral is looking for a true “hunter” with mortgage industry knowledge and extensive contact database, plus demonstrated prior success selling end-to-end mortgage and consumer lending solutions. Knowledge of Artificial Intelligence and Data Analytics is a plus. This is a great opportunity for a business development executive to work with a fintech software company with over 15 years of experience and a broad global client base and help them broaden their reach in the US Market. Location agnostic, but will require some travel to attend industry conferences as well as visit client locations. 1099 Preferred. To learn more or to submit your resume, please contact Peter Sandler, SVP.

NewRez added Baron Silverstein as President and Neeraj Kalani as Chief Marketing Officer.

Lender products & services

Still in need of a digital mortgage platform for your business? It’s not too late or too busy to refine your business for higher margins and a more efficient LO organization. 2020 HW Tech 100 Winner, Maxwell, continues to stand out from the digital mortgage competition with their software designed for the true end user — the loan officer — and a customer success team designed to speed up time-to-value, averaging only 2.5 weeks to launch most clients. Speed matters, and investing now will reap large benefits in the future. To learn more about Maxwell and their mortgage dedicated digital platform, click here or request a demo.

Housing inventory has hit an eight-year low according to Realtor.com, stoking desperation and bidding wars among eager homebuyers. In hot markets, agents know that quickly submitting an offer from a qualified buyer can secure a home under contract, while a prolonged pre-approval can send buyers into a tailspin. SimpleNexus’ “from anywhere” platform makes it easy for LOs to rapidly turn pre-approvals. At GreenState Credit Union, one LO “received an application at 9 pm on a Friday night while riding in a car and was able to deliver a pre-approval within minutes.” Needless to say, the Realtor was blown away. Read the full account here. To learn more about how you can earn a reputation as a stand-out partner to borrowers and real estate agents, schedule a demo with SimpleNexus today.

Even the best-laid plans go awry sometimes. More than 2,500 mortgage pros attend Ellie Mae Experience every year in search of new and innovative ideas. The show’s cancellation, announced yesterday, has left a lot of people with open calendars March 23-25. LBA Ware invites you to block off 15 minutes of that time to square away your incentive comp administration. LBA Ware’s CompenSafe has a plug-and-play Encompass integration that seamlessly retrieves loan pipeline data to automate near real-time incentive compensation management. Book a virtual meeting with LBA Ware’s CEO Lori Brewer to see how CompenSafe streamlines operations, motivates sales teams and improves transparency.

Join National Mortgage Professional Magazine and First Equity Funding on Thursday, March 12 at 2:00 PM Eastern/11:00 AM Pacific, to learn how to “Boost your overall loan origination by working with real estate investors.” Christian Pepe and Anthony Palmiotto will dive into how to work with real estate investors to not only increase your business, but also dramatically increase your conventional and FHA business. They will tell you strategies that can be the gateway to new realtor relationships and first-time home buyer business. Some topics that will be covered include understanding the mindset of a real estate investor, strategies to earn real estate investor business, what is the BRRRR Method and why you need to understand this strategy, increasing first time home buyer business through investor relationships, winning realtor referrals through investor clients, and turning denials into closed loans. Click here to register.

Did you know that only 21% of marketing automation users feel that their capabilities are above average or higher? The most common barriers to success include the absence of a sound strategy and the inability to fuel the content required to nurture different buyer pathways along with poor implementation of the technology. Seroka Brand Developments’ Marketing Automation Optimizer helps you take full advantage of your marketing and sales automation technology. Whether you’re using Marketo, Hubspot, Pardot, Outreach, SalesLoft or any other technology, Seroka can assist you. They have the strategic capability, content development expertise and technical knowledge to drive a successful program for your company. Reach out to Seroka today for a FREE consultation, and get ready to #turnupyourbrand in 2020!

The future of lending awaits. Blend is partnering with industry leaders to create real change. Executives from Navy Federal, Eagle Home Mortgage, and Truist will be speaking at Beyond 2020, Blend’s digital lending conference. Check out the details and join Blend in writing lending’s bright new future.

With application volumes through the roof, lenders already feel like they’re drinking from a firehose. And the surge has just begun. Many are wondering how best to prepare for a fast-paced 2020. In my experience, boom times can quickly overtax processors and underwriters, revealing weak links in workflows that ordinarily seem solid. If you’re drowning in applications and missing turn time targets, you’ll want to zero in on the process inefficiencies that are slowing you down and find ways to improve them. FormFree’s Passport shaves hours of manual work off each loan file by automating asset, income and employment verification in a single report. It not only speeds up processing and underwriting, it also frees originators to spend more time ‘wowing’ borrowers to earn the referrals that will keep you riding high after the market slows. Reach out to Christy Moss for more info.

“Since 1986, Sutherland has been a dedicated partner enabling our clients to maximize their opportunity to build their business portfolio. Today, mortgage volume is surging and lenders are looking for concrete solutions to capitalize on our unprecedented rate environment. Whether your need is Underwriting capacity or portfolio retention, Sutherland has the experience needed. Our dedicated Solution Architects and onboarding specialists develop a sound ramp strategy, and in most cases, have our clients up in less than 45 days. If you would like to schedule a discovery call, reach out to Neil Armstrong, AMP.”

Disaster news

No, this isn’t a report on your lock desk’s morale. Or, at this point a disease update. We’ve had the Pearl River Flooding (Mississippi, Feb 10-14) and Tennessee Tornadoes (March 2-3).

(That said, Lenders Compliance Group published an FAQ that discussed how businesses can proactively prepare for the impact of COVID-19. It is called Pandemic Preparation: Bracing for COVID-19.)

FEMA declared designated counties in Tennessee as disaster areas in DR-4476. The states’ Storms, Tornadoes, Straight-line Winds, And Flooding for the incident period March 3rd warranted Individual Assistance to Davidson, Putnam and Wilson counties.

An update has been made to the Lakeview Loan Servicing Disaster File either declaring a new disaster.

First Community Mortgage posted 2020-02 Delegated Correspondent Announcement that outlines the 4 Tennessee Counties added to the FEMA Declared Disaster list. Its 2020-03 Announcement adds updated information specific zip codes in Davidson County TN. And First Community Mortgage posted 2020-04 and 2020-03 Wholesale Announcement’s regarding FEMA declared disaster areas in Tennessee, along with a disaster update announcement regarding counties in South Dakota for its Delegated Correspondent and Wholesale channels.

An update has been made to the Lakeview Loan Servicing Disaster File regarding DR 4469 – South Dakota Severe Storms, Tornadoes, and Flooding.

Veros Real Estate Solutions announced the availability of a new enhancement to its Disaster Data Solution: Executive Portfolio Dashboard Reporting. This dashboard report provides a visual summary of the potential impact on a portfolio of properties following a natural disaster such as a wildfire, hurricane or earthquake. When a region is declared a disaster area, the Disaster Data Solution allows lenders, servicers, appraisal management companies, and other mortgage transaction participants to determine if a U.S.-based residential property is likely to have been directly affected. This new dashboard visualizes tiered levels of exposure in a portfolio, from no-exposure to maximum-exposure, displaying potentially impacted areas in relation to properties in the portfolio. Veros Disaster Data Solution allows a servicer to: Pinpoint which borrowers to focus immediate outreach. Prioritize properties for property condition inspection. Protect servicers real estate assets. Gain an executive dashboard overview of portfolio exposure. Maintain compliance with GSE disaster policy regulations.

Capital markets

Last week’s positive economic data was eclipsed by the continued spread of the coronavirus and the unexpected emergency 50 basis point rate cut to the Fed Funds Rate by the Federal Reserve. While the number of patients being treated in the US remains a fraction of those overseas, financial markets were volatile and the 10-year Treasury bond yield sank to a record low of 0.69 percent. Most experts expect a global economic slowdown as a result of the virus and the resulting impacts of quarantines and production shutdowns in the supply chain. Despite the emergency rate cut, the markets still expect the Fed to cut further following the upcoming FOMC meeting on March 18th with a near 100 percent probability of a 25-bps rate cut and potentially even another 50bps rate cut. Financial markets will closely watch industrial data coming from China which already say auto sales decrease 80 percent year over year in February. Predicting the full economic impact of the coronavirus remains a challenge especially given the uncertainty about how and where the virus will spread.

My daughter tells me that Mercury is in retrograde (whatever that means), and that is why markets are so panicked. U.S. Treasury yields on the 5-year note, 7-year note, 10-year note, and 30-year note all sank to fresh historical lows yesterday. In addition to further coronavirus concerns, the rally was prompted by a plunge in the price of oil after Saudi Arabia cut its wholesale prices for April and signaled plans to increase production, launching a price war with Russia after OPEC failed to agree to a production cut last week. Oil prices are down 50% in the last couple months. The 10-year yield fell to a record low of 0.398 percent during trading before closing the day -21 bps to 0.50 percent. The fed funds futures market is now pricing in a 75-bps cut to the Fed Funds Rate on or before March 18. The market selloff speaks to a sense that policy makers are falling further and further behind the virus.

In addition to oil seeing its worst price drop since 1991, Japan posted a 7.1 percent decline in Q4 GDP, even worse than expected, analysts now say Europe will almost certainly fall into a recession, China’s January/February trade deficit totaled $7.09 billion (the expected surplus was $24.60 billion; the prior surplus was $47.21 billion), and gold, which tends to rise when investors are worried about the stock market, did just that. I’d like to sit here and say the virus does not justify the panic, but once financial markets are spooked, they move with a mind of their own.

As I said yesterday, economic releases matter little these days. Today, besides a big bounce back in stock markets, sees another relatively light calendar, which began with the NFIB Small Business Optimism Index for February. The Treasury will conduct the first leg of this week’s mini-Refunding when $38 billion 3-year notes are auctioned in the afternoon. The Desk will conduct a GNII FedTrade operation targeting up to $288 million 2.5 percent ($124 million) and 3 percent ($164 million). We begin today with Agency MBS prices all over the map but generally worse .125 and the 10-year yielding .64 percent.

Paddy was driving down the street in Chicago sweating because he had an important meeting and couldn’t find a parking place.

Looking up to heaven he said, “Lord take pity on me. If you find me a parking place, I will go to Mass every Sunday for the rest of me life and give up me Irish Whiskey!”

Miraculously, a parking place appeared at Deloitte and N Clark.

Paddy looked up again and said, “Never mind, I found one.”

Visit www.robchrisman.com for more information on our industry partners, access archived commentaries, or to subscribe to the Daily Mortgage News and Commentary. If you’re interested, visit my periodic blog at the STRATMOR Group web site. The current blog is, “Drinking from a Firehose is Not a Long Term Business Model” If you have the inclination, make a comment on what I have written, or on other comments so that folks can learn what’s going on out there from the other readers.

Rob

(Market data provided in partnership with MBS Live. For free job postings and to view candidate resumes visit LenderNews. Currently there are hundreds of mortgage professionals looking for operations, secondary and management roles. For up-to-date mortgage news visit Mortgage News Daily. For archived commentaries, or to subscribe, go to www.robchrisman.com. Copyright 2020 Chrisman LLC. All rights reserved. Occasional paid job listings do appear. This report or any portion hereof may not be reprinted, sold or redistributed without the written consent of Rob Chrisman.)

Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

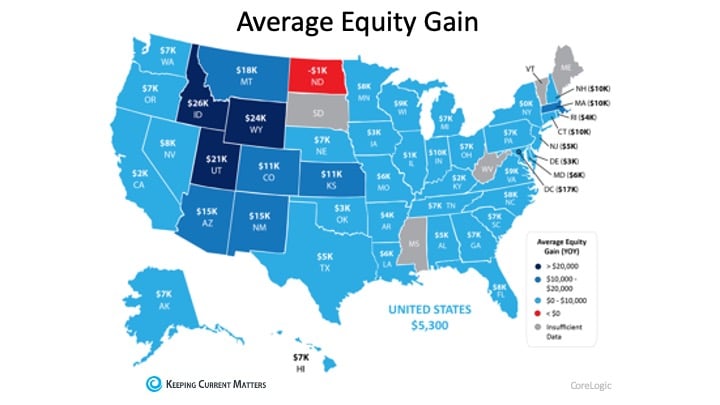

CoreLogic also notes:

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state. Bottom Line

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home.

The post Equity Gain Growing in Nearly Every State appeared first on Keeping Current Matters.

Remortgage – Isn’t It Time You Got A Better Deal? is courtesy of: ABLEnding, Inc California

Remortgage – Isn’t It Time You Got A Better Deal?

If you have had your mortgage for some time, then it could be a good idea to get it out and look at it real good. Why? Simply because you may be able to get a much better deal. With interest rates changing every day, new loan options, and increasing equity on your house, means that many factors may now mean that you could reduce your mortgage payments each month, or more. Here is how you can determine if a better deal is possible for you.

Decide On Future Plans

Remortgaging your house may not be for everyone. This is especially true if you are thinking of moving in less than three years – or even five. The main reason for this is the cost of refinancing your mortgage. There will be some closing costs involved, so it will take you anywhere between one and three years to get this money back in order to break even. But if you are planning on staying more than that, you should do some serious thinking about a remortgage.

Check The Current Rate For Mortgages

The interest rates that are available for mortgages change every day – sometimes even more often than that. The important thing is that they are constantly changing – both up and down. By watching trends on the mortgage rates, and knowing your own rate of interest, you can see when the rates drop to more than 1% lower than what you have now. That is the time to refinance. Or, even better, if you see a slow downward trend, wait a few more days or a week or so, and it may even go lower. You will have to decide on the best time. You may also want to consider the advice of those who know the market and make predictions.

Get Better Terms

Since your financial situation may have changed over recent years, you may want to make some adjustments on your mortgage that reflects those changes. If you are doing financially better, then you can remortgage, get lower rates, and a shorter time for repayment. This will result in saving a lot of money overall and get you out of debt quicker.

If, on the other hand, your financial situation has not been so good lately, and you are feeling the pinch on your finances, then remortgaging could allow you to get lower monthly payments, your some of your equity, and stretch out the time period for repayment. A longer time period, however, may result in greater indebtedness.

Consider Getting Some Of Your Equity

One more thing. Getting a remortgage can also give you access to your equity – some or all of it. There are different types of mortgages that you can get in order to get what you want. Although the best way to reinvest your equity is to put it back into the house – at least some of it, it could also give you opportunity to do a debt consolidation, to buy a car or boat, or pay for medical bills or college. The choice belongs to you as to how you use it. When you use it on your house, it also becomes tax deductible, too.

ABLEnding, Inc,

1455 Frazee Road

Suite 500

San Diego, CA 92108

(805) 209-0123

Mortgages. The Pitfall Of Interest Only Mortgages. was originally seen on: ABLEnding, Inc California Blog

In the first three months of 2002, just 9% of all new mortgages were taken as interest only – but by the last quarter of 2005, the figure had risen to 23%. And amongst first time buyers, the figures rose from 6% to 15%. (Source: Council of Mortgage Lenders.)

The reason is obvious. It’s down to family economics. With an interest only mortgage, the monthly repayments only repay the ongoing interest so your monthly repayment is low. Repayment of the capital borrowed is delayed to the end of the mortgage when it has to be repaid as a lump sum.

So the popularity of interest only mortgages is a reflection of borrowers wanting to minimise their fixed monthly outgoings in order to preserve their lifestyle – they still want their nice cars, nights out and holidays abroad. But their reluctance to cut back on their life style spending, combined with steadily rising house prices, could be storing up problems for the future. If they’re not repaying some of the capital now, how are they going to repay it?

Egged on by the concerns voiced by the Financial Services Authority (FSA), many lenders are now becoming much stricter when assessing an application for an interest only mortgage. They’re insisting that there’s a viable repayment vehicle in place before they’ll payout the money. These repayment vehicles could be the tax-free cash forecast from a pension policy, or an ISA or some other regular investment or savings scheme. The danger is that having got the mortgage, the borrower subsequently cancels their savings scheme.

If that were to happen, when retirement finally arrives accompanied by the looming commitment to repay the mortgage capital, they’ll be faced with having to sell their home and down size simply to free up money to repay the mortgage. And that’s a scenario that lenders and the FSA are anxious to avoid.

Twenty years ago interest only mortgages were the accepted norm with endowment policies being used as the most popular investment to repay the capital. But as we now know, returns on endowment policies have not been as high as many had assumed. This has left thousands of homeowners with a capital repayment shortfall. Endowment policies have certainly failed to be the “guaranteed “ repayment solution that many of us had assumed twenty years ago. So, in today’s economic and investment environment, how certain can you be of any scheme to repay the capital?

When the shortcomings of endowment policies slowly became understood, interest only mortgages fell out of favour and repayment mortgages took over as the norm. But once again the pendulum is swinging. Interest only mortgages are back in a big way. It’s the result of high house prices and people straining to get onto and up the housing ladder without wanting to economise on other areas of their spending.

We’re sure that the pressures within family finances will continue to fuel the demand for interest only mortgages. However, it becomes the duty of mortgage brokers and the lenders to point out the alternatives open to their clients.

In the past, a 25 year mortgage term has been the norm for a young buyer. But now they can stretch the repayment period to 30, even 35 years. This makes the payments on a repayment mortgage far more affordable.

For example, the monthly repayments for a £125,000 repayment mortgage over 25 years at say, 4.9% cost £731.69 per month, but if the repayment period was stretched to 35 years, the repayment drops to £628.16 per month, a cash flow saving of £103.53.

The idea is that as and when family finances permit, borrowers can reduce the capital outstanding by making optional lump sum repayments. In practice, people tend to move house every eight to ten years and at each move a new mortgage has to be organised. These moves then represent an obvious opportunity to reassess long-term family finances.

But other solutions are available. You could arrange a mortgage where part of the loan is on a repayment basis with the balance on interest only. It’s a mid way option. At least these types of mortgage start the repayment process and later when you move home or the family income builds, you can take the opportunity to reassess the most suitable type of mortgage.

But please bear in mind that you shouldn’t speculate when it comes to your home finances. Mortgages are complicated and there is never just one solution. Our advice is take professional advice and use a mortgage broker who can search the entire market.

ABLEnding, Inc,

1455 Frazee Road

Suite 500

San Diego, CA 92108

(805) 209-0123

BoostMyScore.net (BMS), a Colorado-based credit repair company and its owner have agreed to settle Federal Trade Commission charges they mislead consumers with promises to “drastically and immediately” improve credit scores and increase access to lower rates on mortgages. In its complaint, the FTC alleges that the defendants guaranteed consumers that, in exchange for fees ranging […]